bagmetstudio.ru

Gainers & Losers

Average Motorhome Insurance Cost

Compare RV Insurance Quotes. Find the best RV insurance quotes from top insurers in Canada and enjoy your motorhome! The average cost of RV insurance depends. How much does class A motorhome insurance cost? You can insure your class A motorhome with a liability policy for as low as $ *Read the associated. The average insurance cost ranges from around $1, to $4, or more per year. Class C motorhomes should be slightly cheaper to insure than Class As, with. On average, Class A RV insurance can range from 1, to 5, dollars annually. Class B RVs are the smallest of the classes and, in turn, have the lowest costs. The average premium for a month RV insurance policy at Progressive for was $ for a travel trailer and $ for a motorhome. Since an RV can be more than just a vehicle, RV owners may use their motorhome for either part- or full-time travel. Insurance coverages for motorhomes and RVs. The cost to insure a motorhome ranges from $ to $ per year, while towable campers cost between $ and $ With Progressive, your class C motorhome insurance can cost as little as $ per year for an RV liability insurance policy. This includes fuel, maintenance, and insurance costs. How many miles can one travel in that time period with such expenses? Compare RV Insurance Quotes. Find the best RV insurance quotes from top insurers in Canada and enjoy your motorhome! The average cost of RV insurance depends. How much does class A motorhome insurance cost? You can insure your class A motorhome with a liability policy for as low as $ *Read the associated. The average insurance cost ranges from around $1, to $4, or more per year. Class C motorhomes should be slightly cheaper to insure than Class As, with. On average, Class A RV insurance can range from 1, to 5, dollars annually. Class B RVs are the smallest of the classes and, in turn, have the lowest costs. The average premium for a month RV insurance policy at Progressive for was $ for a travel trailer and $ for a motorhome. Since an RV can be more than just a vehicle, RV owners may use their motorhome for either part- or full-time travel. Insurance coverages for motorhomes and RVs. The cost to insure a motorhome ranges from $ to $ per year, while towable campers cost between $ and $ With Progressive, your class C motorhome insurance can cost as little as $ per year for an RV liability insurance policy. This includes fuel, maintenance, and insurance costs. How many miles can one travel in that time period with such expenses?

USAA offers RV insurance for your motorhome, travel trailer, camper and fifth wheel. Learn more about RV insurance costs, rates and coverage. After all, it's not inexpensive, the average cost of a camper can range between $25, to $30, Now if you calculate the insurance and maintenance that goes. If you have a house or cabin trailer, tent trailer, or motorhome, you'll need to insure your RV. Unlike typical auto or home insurance, trailer. Email us at [email protected] and we'll help you find the cheapest rates on RV insurance — just like that. motorhome, trailer, park model, etc.). According to the National Automobile Dealers Association (NADA), the average insurance premium for a gas-powered Class A motorhome is around $1,$1, According to estimates, the average annual insurance premium for a gas-powered Class A motorhome is approximately $1,$1,, based on usage of days per. Average Motorhome Insurance Cost · Motorhome insurance: £ · Campervan insurance: £ Geico rate for my GeoPro 19TH (purchased new and has a lien) is $ a year. Upvote. RV coverage costs vary widely due to numerous factors, but the average cost in the U.S. falls somewhere between $ to $3, per year. Why such a wide gap. Allstate can help you protect your motorhome with quality RV insurance coverage and the support of a knowledgeable agent who are there for you. Luckily, Class B motorhome insurance is not the most expensive you can get, with the average policy costing between $$1, per year. This is cheaper. How much does RV insurance cost in Alberta? Motorhome insurance starts at $ per year while trailer insurance starts at $ per year. Your rates will depend. Class A Motorhome Insurance Cost. The average cost of class A motorhome insurance is between $1, to $2, per year. However, luxury models with higher. Protect your RV, travel trailer, camper, or motorhome with RV insurance We'll need to know the number of days you use your vehicle per year on average to give. It won't cost nearly as much to insure a small Class B motorhome with few Class A motorhomes are huge, cumbersome vehicles that don't drive like your average. Generally, less pricey RVs cost less to insure; more extensive and more elaborate motorhomes cost more to insure. Not Your Average Insurance Broker! Start your free quote online today for all your RV insurance needs. State Farm has competitive rates with not only an easy claims process, but 24/7 customer. Motorhome insurance. MOTORHOME COVER WORTH THE ROAD TRIP. Start a quote. Search for a great deal on motorhome and campervan insurance. We have it added to our insurance package which includes a car, a truck, a motorhome and a fifth wheel. Full coverage on the motorhome is $21 a. According to Finder Australia, the average cost to insure a motorhome ranges from several hundred dollars to over $ per year. It will also depend on.

Can You Contribute To Roth Ira And Traditional Ira

As a couple, you can contribute a combined total of $14, (if you're both under 50) or $16, (if you're both 50 or older) to a traditional IRA for If. The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans. You can have both but the total contribution to both combines for 7k. Split that 7k any way you want between them. For a traditional IRA, you cannot contribute after age 70 ½ and distribution is required at that age, while there are no age requirements associated with a Roth. You can have both but the total contribution to both combines for 7k. Split that 7k any way you want between them. Yes, you can, but only if you have taxable compensation. Roth IRAs were designed to help people save for retirement with the advantage of tax-free growth. You may contribute simultaneously to a Traditional IRA and a Roth IRA (subject to eligibility) as long as the total contributed to all (Traditional and/or Roth). If you assume your taxable income during retirement will be lower, it may make sense to take the tax break now by contributing to a. Traditional IRA, then pay. If you have Roth IRAs, your income could affect how much you can contribute. Are traditional IRA contributions % tax-deductible? You may take a full. As a couple, you can contribute a combined total of $14, (if you're both under 50) or $16, (if you're both 50 or older) to a traditional IRA for If. The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans. You can have both but the total contribution to both combines for 7k. Split that 7k any way you want between them. For a traditional IRA, you cannot contribute after age 70 ½ and distribution is required at that age, while there are no age requirements associated with a Roth. You can have both but the total contribution to both combines for 7k. Split that 7k any way you want between them. Yes, you can, but only if you have taxable compensation. Roth IRAs were designed to help people save for retirement with the advantage of tax-free growth. You may contribute simultaneously to a Traditional IRA and a Roth IRA (subject to eligibility) as long as the total contributed to all (Traditional and/or Roth). If you assume your taxable income during retirement will be lower, it may make sense to take the tax break now by contributing to a. Traditional IRA, then pay. If you have Roth IRAs, your income could affect how much you can contribute. Are traditional IRA contributions % tax-deductible? You may take a full.

It's possible to have both Roth and traditional IRAs in your investment portfolio. You can contribute to both as long as your total contributions don't exceed. However, you'll pay taxes on the distribution. You can set up a traditional IRA at any time and make contributions as long as you (or your spouse, if you file. Both traditional IRAs and Roth IRAs are tax-advantaged investment accounts you can use regardless of your employment status. But they differ in two important. You can contribute to both types as long as your total contribution doesn't exceed the Internal Revenue Service (IRS) annual limit. You can contribute to both types as long as your total contribution doesn't exceed the Internal Revenue Service (IRS) annual limit. You may contribute simultaneously to a Traditional IRA and a Roth IRA (subject to eligibility) as long as the total contributed to all (Traditional and/or Roth). Since contributions to a Roth IRA are made with after-tax dollars, there is no tax deduction regardless of income. You can contribute at any age as long as you. The maximum amount you can contribute in across all your IRAs—traditional or Roth—is $7, ($8, if you're age 50 or older). However, some rules affect. Explore the differences between a Roth IRA and a Traditional IRA to see which option may be right for you. · If you are under age 50, you can contribute a. You can choose one or both depending on your tax situation and income, but all IRAs together are subject to the combined contribution limit. Traditional IRAs. You can contribute to a Roth IRA at any age. As a result of changes made by the SECURE Act, you can make contributions to a traditional IRA for or later. Generally, traditional IRAs are most effective if you expect to be in a lower tax bracket when you retire, while Roth IRAs are best for those in a lower tax. It may be appropriate to contribute to both a traditional and a Roth IRA—if you can. Doing so will give you taxable and tax-free withdrawal options in. These days, there are two IRA types: traditional and Roth. You can contribute to these retirement savings vehicles in addition to an employer-sponsored plan if. Can You Contribute to Both a Roth and Traditional IRA? Diversifying your retirement savings strategy by contributing to both Roth and Traditional IRAs can. Yes, a person can contribute to a Roth IRA and a traditional IRA in the same year. The IRS annual contribution limit is still for the combined. Can you have both types of IRAs? You may have both types of IRAs, but your annual contribution for all IRA accounts is capped at $6, total for investors. Cash means currency or negotiable instruments. Once the IRA account is established, the funds can generally be invested in almost any type of investment. Can I roll my (k) into an IRA? This means if you're 49 years old, for example, and wish to contribute to a Roth as well as a traditional IRA, you can contribute $3, to one and $4, to.

Can I Transfer Money From My Bank To Another Bank

Move money between your US Bank accounts – and to and from accounts at other banks. With US Bank mobile and online banking, you can safely control your money. You can make an instant transfer from one Ally Bank account to another 24/7 online or through our mobile banking app. To Transfer Money Between Accounts in the Mobile App: · Tap Move Money in the Navigation Bar · Tap Transfer Between My Accounts · Follow the on-screen instructions. Bank to bank transfers can be made between your M&T personal deposit account(s) including, M&T Checking, Savings or Money Market and your verified non-M&T. You can transfer money between your bank accounts on Google Pay. Note: Both bank accounts should be added to your Google Pay account. You can transfer money from one bank to another via an electronic transfer. Both accounts could be yours, or one could belong to someone you're paying. You can. You can transfer money between banks through your financial institution's website or app. · You may want to use a wire transfer if you're sending a large amount. You can transfer money between your Wells Fargo checking and savings accounts and accounts you may have at other US financial institutions. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option. Move money between your US Bank accounts – and to and from accounts at other banks. With US Bank mobile and online banking, you can safely control your money. You can make an instant transfer from one Ally Bank account to another 24/7 online or through our mobile banking app. To Transfer Money Between Accounts in the Mobile App: · Tap Move Money in the Navigation Bar · Tap Transfer Between My Accounts · Follow the on-screen instructions. Bank to bank transfers can be made between your M&T personal deposit account(s) including, M&T Checking, Savings or Money Market and your verified non-M&T. You can transfer money between your bank accounts on Google Pay. Note: Both bank accounts should be added to your Google Pay account. You can transfer money from one bank to another via an electronic transfer. Both accounts could be yours, or one could belong to someone you're paying. You can. You can transfer money between banks through your financial institution's website or app. · You may want to use a wire transfer if you're sending a large amount. You can transfer money between your Wells Fargo checking and savings accounts and accounts you may have at other US financial institutions. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option.

The bank will require you to provide identification; make sure you have the required identification documents before you attempt to process the transaction. If you're simply transferring money from one account to another within the same financial institution, this is something you can easily do at your bank for free. You don't have to transfer a large amount - start with a small transfer if you need to. You can do a direct deposit into your new account or withdraw money from. Quickly transfer money between your First Hawaiian Bank accounts or from one bank to another with FHB Online and FHB Mobile Banking. Transfer money between your different accounts Move and manage your money 24/7 using Online Banking or the mobile app. Online Banking lets you set up transfers. With Bank to Bank Transfers, you can easily move money between your US HSBC deposit accounts and your accounts at other US financial institutions. How to transfer money · Step one Sign in to the Chase Mobile® app and tap "Pay & Transfer" · Step two Tap "Transfer" and then choose "Account or Brokerage. Transfer money from one bank account to another If you need to transfer money between two of your own accounts at different banks, the process is typically. Can I transfer funds from my personal accounts to my business accounts using online banking? Send bank to bank wire transfers, (EFTs) from the United States internationally to a bank account and save on ACH fees. Now, you can also send money to US. You can transfer money between your Wells Fargo checking and savings accounts and accounts you may have at other US financial institutions. On average, wire transfer fees can range anywhere from $0 to $50 depending on where your money is going. The recipient may also be required to pay fees to. A bank transfer lets you move money from one bank account to another. It's usually instant, free and done using mobile or online banking, over the phone or in. We recommend that you do not use Zelle® to send money to those you do not know. Keep in mind, when using Zelle, money moves from your bank account to another. You can transfer as much money as you want without a problem, so long as it is done between accounts within the banking system, or via personal. Yes, you can transfer funds between two different accounts at the same bank if both accounts are under your name. This can usually be done. A bank account transfer is an electronic payment which sends money directly from one bank account to another. How does a bank account transfer work? A bank. When you transfer money from your Apple Cash1 card, you can either use a bank transfer to send funds to your bank account in 1 to 3 days or you can use Instant. You can also add recipients from your contacts and request money from multiple people to easily split a bill. Through our mobile app with Zelle®, all you need. One of the fastest ways to transfer money between bank accounts is with an ACH debit, provided both accounts are linked.

How Much Is Peacock Ad Free

The steaming service provides a free ad-supported tier with limited content and two paid subscription plans: Peacock Premium ($/month) and Peacock Premium. Instacart+ members in the United States can receive a Peacock Premium subscription at no additional cost. The Peacock Premium subscription is Peacock's ad-. There is an ad-free tier - it's called "Peacock Premium Plus" and costs $ You also get live local NBC. But it makes no sense that the. The Peacock Premium Plus Tier (without ads): For those averse to advertising completely, a higher subscription cost offers an ad-free experience, except in. Peacock has a free plan with ads, as well as premium plans with ads-free viewing and additional content. For the most up-to-date information. The free ad-supported plan is an attractive offer for consumers who want to cut down on costs. The platform also offers two subscription packages. The premium. Commercial-Free Plan: Peacock's commercial-free plan, as the name suggests, offers an uninterrupted streaming experience without any. There is an ad-free tier - it's called "Peacock Premium Plus" and costs $ You also get live local NBC. But it makes no sense that the. I don't know if it will have ads. If it doesn't then you will get a screen saying the broadcast will resume shortly instead of the ads. Definitely not worth the. The steaming service provides a free ad-supported tier with limited content and two paid subscription plans: Peacock Premium ($/month) and Peacock Premium. Instacart+ members in the United States can receive a Peacock Premium subscription at no additional cost. The Peacock Premium subscription is Peacock's ad-. There is an ad-free tier - it's called "Peacock Premium Plus" and costs $ You also get live local NBC. But it makes no sense that the. The Peacock Premium Plus Tier (without ads): For those averse to advertising completely, a higher subscription cost offers an ad-free experience, except in. Peacock has a free plan with ads, as well as premium plans with ads-free viewing and additional content. For the most up-to-date information. The free ad-supported plan is an attractive offer for consumers who want to cut down on costs. The platform also offers two subscription packages. The premium. Commercial-Free Plan: Peacock's commercial-free plan, as the name suggests, offers an uninterrupted streaming experience without any. There is an ad-free tier - it's called "Peacock Premium Plus" and costs $ You also get live local NBC. But it makes no sense that the. I don't know if it will have ads. If it doesn't then you will get a screen saying the broadcast will resume shortly instead of the ads. Definitely not worth the.

Commercial-Free Plan: Peacock's commercial-free plan, as the name suggests, offers an uninterrupted streaming experience without any. No, Peacock TV has ads for both their free and premium service. To block ads on Peacock for free, install Ghostery Ad Blocker Extension on your browser. How Much Is Peacock Premium?If you don't mind sitting through some ads, sign up for the Peacock Premium plan for $/month or $/year. Big Ten Football, and WWE. *Due to streaming rights, a small amount of programming will still contain ads (Peacock channels, events and a few shows and movies). You will be charged $6 per month or $60 per year for Peacock Premium Plus, in addition to any charges for Peacock Premium. Peacock's Binge Ads are exclusive sponsorships that reward viewers with an ad-free episode. When the user has watched two consecutive episodes in a row of the. Beginning in mid-July, the price for Peacock Premium (with ads) will ad-free) is also going up by $2 to $ per month. Peacock Premium's. Peacock offers a free subscription with limited access to 40, hours of video and plenty of advertisements. However, Peacock has too many commercials and ads. Starting today, the price for Peacock Premium (with ads) will increase by $2 to $ per month and Peacock Premium Plus (mostly ad-free) is. Peacock Premium Plus · Stream everything you get with Premium, ad-free (with limited exclusions). · Plus, watch your local NBC channel LIVE, 24/7, and download. You can't skip advertisements on Peacock, but you can upgrade to Peacock Premium Plus to watch with limited interruptions. Peacock Pricing and Plans ; Plan Features, Peacock Premium, Peacock Premium Plus ; Price, $ per month, $ per month ; Ads, Yes, No ; Shows, Current shows. How much does a Peacock subscription cost? You can sign up for a Peacock Premium plan at $ a month (+tax) or $ per year (+tax). Peacock Premium Plus costs $ per month and provides ad-free experiences on most content. However, note that due to local streaming rights, some live. You can't skip advertisements on Peacock, but you can upgrade to Peacock Premium Plus to watch with limited interruptions. Select your Peacock Plan so you can enjoy all your favorite shows. How much does Peacock TV cost? · Peacock Free is $0/month with 7, hours of programming, current series, TV classics, and movies. · Premium is $/month with. Download Peacock, NBCUniversal's streaming service. Peacock has all your favorite culture-defining entertainment, all in one place. You will be charged $6 per month or $60 per year for Peacock Premium Plus, in addition to any charges for Peacock Premium. Peacock is getting another price hike. Starting this summer, Peacock's ad-supported Premium plan will go from $ to $ per month, and its Premium Plus.

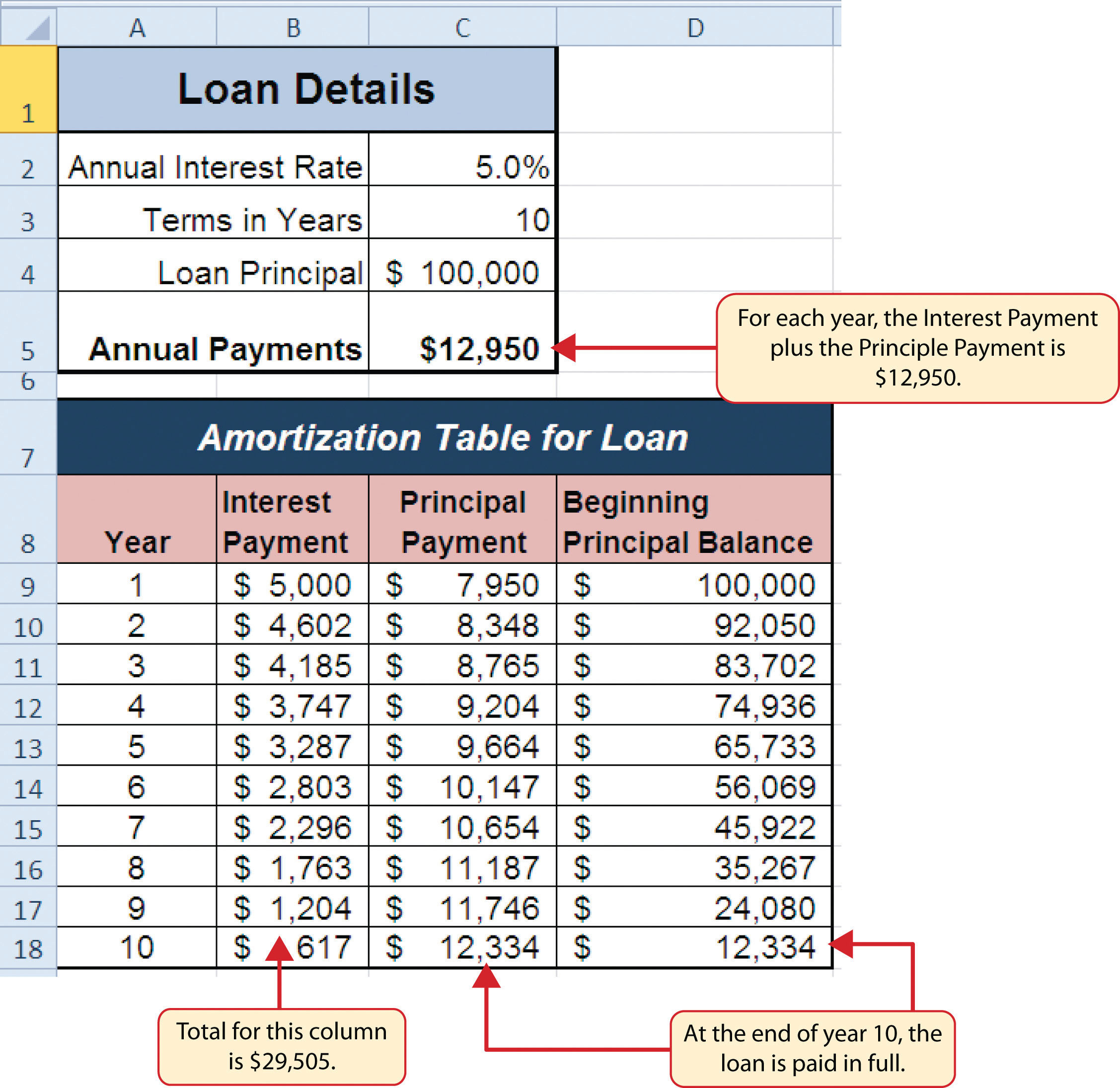

How To Get Amortization Schedule

A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function. An amortization schedule is a table that provides both loan and payment details for a reducing term loan. · In general, amortization schedules are provided to. Online banking users: Select My Loan at the top of the page. Locate the "Amortization schedule" section and select More details. A pop-up window will open with. Note: If you choose an amortization period over 25 years, you must have a down payment of at least 20%. Example. See the the chart below. It shows the impact of. How to Prepare an Amortization Schedule · Payments Formula · Calculating Payment towards Interest · Calculating Payment towards Principal · Amortization Schedule. An amortization schedule is a data table that shows the progress of you paying off your mortgage loan. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time. Figure out how to calculate your mortgage amortization. The amortization table shows how each payment is applied to the principal balance and the interest owed. Payment Amount = Principal Amount + Interest Amount. How to create an amortization schedule in Excel · 1. Create column A labels · 2. Enter loan information in column B · 3. Calculate payments in cell B4 · 4. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function. An amortization schedule is a table that provides both loan and payment details for a reducing term loan. · In general, amortization schedules are provided to. Online banking users: Select My Loan at the top of the page. Locate the "Amortization schedule" section and select More details. A pop-up window will open with. Note: If you choose an amortization period over 25 years, you must have a down payment of at least 20%. Example. See the the chart below. It shows the impact of. How to Prepare an Amortization Schedule · Payments Formula · Calculating Payment towards Interest · Calculating Payment towards Principal · Amortization Schedule. An amortization schedule is a data table that shows the progress of you paying off your mortgage loan. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time. Figure out how to calculate your mortgage amortization. The amortization table shows how each payment is applied to the principal balance and the interest owed. Payment Amount = Principal Amount + Interest Amount. How to create an amortization schedule in Excel · 1. Create column A labels · 2. Enter loan information in column B · 3. Calculate payments in cell B4 · 4.

Then, once you have calculated the payment, click on the "Printable Loan Schedule" button to create a printable report. You can then print out the full. A schedule that breaks down how principal and interest are applied with each monthly payment throughout the life of a loan. Enter your desired payment - and the tool will calculate your loan amount. Or, enter the loan amount and the tool will calculate your monthly payment. An amortization schedule is a table detailing each periodic payment for amortizing a loan. Amortization is the process of paying off a debt over time through. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly payment. Our free business loan calculator will help you to calculate your monthly payments and the interest cost of your loan. Simply put, an amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Amortization. How to calculate amortization · Step 1: Convert the annual interest rate to a monthly rate by dividing it by · Step 2: Multiply the loan amount by the monthly. An amortization schedule is a table that displays each payment for your loan under a structured plan, detailing how each installment covers both interest and. An amortization schedule is a table that displays each payment for your loan under a structured plan, detailing how each installment covers both interest and. How to calculate amortization · Step 1: Convert the annual interest rate to a monthly rate by dividing it by · Step 2: Multiply the loan amount by the monthly. A mortgage amortization schedule displays the amount of each payment that goes toward principal and interest. It will also show you how your total balance will. Amortization Schedule Calculator It also determines out how much of your repayments will go towards the principal and how much will go towards interest. Export to Excel/.xlsx and Word/.docx files. · Calculate loan payment amount or other unknowns · Supports 9 types of amortization. · User can set loan closing date. How to read an amortization schedule An amortization schedule for a loan is a list of estimated monthly payments. At the top, you'll see the total of all. ƥ = rP / n * [1-(1+r/n)-nt]; ƥ = * , / 12 * [1-(1+/12)-. An amortization calculator enables you to see how much interest and principal (the debt) paid will be in any month of your loan. To use our mortgage. The loan amortization schedule describes the allocation of interest payments and principal repayment across the maturity of the loan. The borrower is required. There are tables that can be consulted and calculators that contain the formulae required to make the calculation when provided with the basic details of loan.

What Is The Average Mortgage Rate Right Now

The average insured mortgage interest rates in Canada on a 5-year fixed-rate mortgage are down 1 basis points since last week and now stand at %. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Meanwhile, today's average year fixed refinance interest rate is %, falling 5 basis points since the same time last week. For now, the consensus is that. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; %. Mortgage Rates ; VA Loans · % · % ; Military Choice · % · % ; Conventional Fixed Rate · % · % ; Homebuyers Choice · % · %. Right. Width: Height: Apply Reset. Show The weekly mortgage rate is now based on applications submitted to Freddie Mac from lenders across the country. All you can do to find the best deal is compare today's current mortgage rates. Below, you can take a look at the average posted, or advertised, rates for. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. To see the current best Canada mortgage rates from the Big 5 Banks, click on the "Best bank rates" tab. bagmetstudio.ru Insights: Variable mortgage rates have. The average insured mortgage interest rates in Canada on a 5-year fixed-rate mortgage are down 1 basis points since last week and now stand at %. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Meanwhile, today's average year fixed refinance interest rate is %, falling 5 basis points since the same time last week. For now, the consensus is that. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; %. Mortgage Rates ; VA Loans · % · % ; Military Choice · % · % ; Conventional Fixed Rate · % · % ; Homebuyers Choice · % · %. Right. Width: Height: Apply Reset. Show The weekly mortgage rate is now based on applications submitted to Freddie Mac from lenders across the country. All you can do to find the best deal is compare today's current mortgage rates. Below, you can take a look at the average posted, or advertised, rates for. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. To see the current best Canada mortgage rates from the Big 5 Banks, click on the "Best bank rates" tab. bagmetstudio.ru Insights: Variable mortgage rates have.

As of September 4, , the average year-fixed mortgage APR is %. Terms Explained. 3. The average APR on a year fixed-rate mortgage fell 2 basis points to % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 7 basis. View current home loan rates and refinance rates for year fixed, year fixed and more. Compare rates to find the right mortgage to fit your goals. Fannie Mae expects the average year fixed mortgage rate to trend slightly down between for Q3 and Q4 Fannie Mae forecasts the downward trend will. Current Mortgage Rates from Super Brokers · 1 Year, %, %, %, Aug 27, · 2 Year, %, %, %, Aug 27, · 3 Year, %, %, %. The current average year fixed mortgage rate fell 1 basis point from % to % on Wednesday, Zillow announced. The year fixed mortgage rate on. However, it could be more of a slow burn opposed to a rapid decline. Fannie Mae and the Mortgage Bankers Association forecast the average year fixed rate. The average mortgage rate for that year was %. That year marked an incredibly appealing homeownership opportunity for first-time homebuyers to enter the. The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to. Today's Locked Mortgage Rates ; YR. CONFORMING. % − ; YR. CONFORMING. % − ; YR. JUMBO. % − ; YR. FHA. % − Fixed-term fixed-rate mortgages. · 1-year fixed-term residential, % · 2-year fixed-term residential, % · 3-year fixed-term residential, % · 4-year fixed. The charts below show current purchase and switch special offers and posted rates for fixed and variable rate mortgages, as well as the Royal Bank of Canada. , %, %, %. CURRENT MORTGAGE RATES. Today's Mortgage Rates · Rate Volatility | Historic Rates. RATE SURVEYS. Mortgage News Daily · Freddie Mac. The best way to get your current mortgage rate is to let us estimate it based on your unique details. We have two that show you what mortgage interest rates. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly Current Mortgage Rates Data Since year refinance: %; year refinance: %. Find the best mortgage rates you can qualify for right now! How. As of August 29, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, Mortgage rates as of September 4, ; % · % · % · % ; $1, · $1, · $1, · $1,

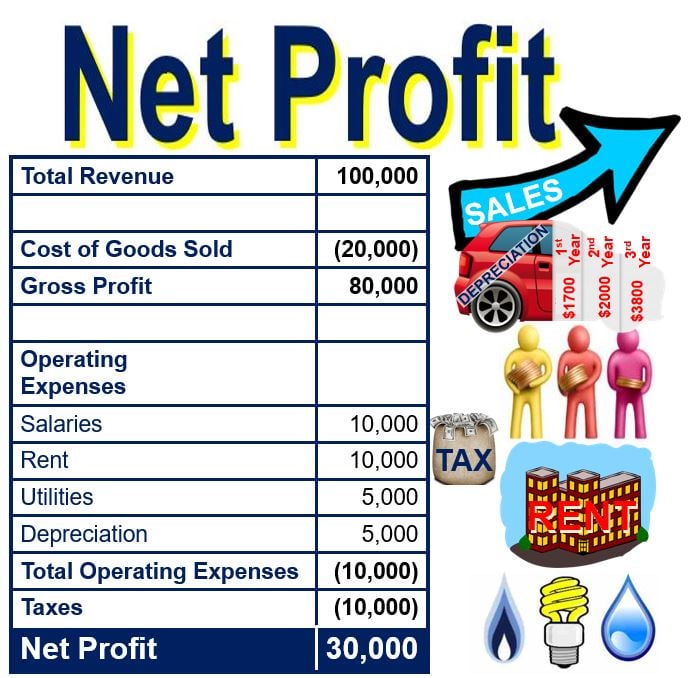

What Is The Meaning Of Net Income

Net income is the profit a company made after all business expenses, such as taxes and deductions, have been paid. Net revenue, or net income, is the total amount of money you make from sales minus your direct expenses. It shows your business's total profits. For households and individuals, net income refers to the (gross) income minus taxes and other deductions (e.g. mandatory pension contributions). A company's net income is positive when revenues are sufficient to cover costs and expenses, including interest and taxes. Although net income may result in. When figuring adjusted net income, there will be no exclusions, deductions, or credits unless otherwise provided under income modifications and deduction. In the case of individuals, net income equals earnings accrued in a given period minus a few specific expenses and financial obligations. In other words, the. Net income is the profit your business earns after expenses and allowable deductions. Gross income and net income can provide a different perspective and affect. A company's net revenue represents the total amount it makes from its operations minus any adjustments such as refunds, returns, and discounts. A company's net. Net income is the amount of accounting profit a company has left over after paying off all its expenses. Net income is the profit a company made after all business expenses, such as taxes and deductions, have been paid. Net revenue, or net income, is the total amount of money you make from sales minus your direct expenses. It shows your business's total profits. For households and individuals, net income refers to the (gross) income minus taxes and other deductions (e.g. mandatory pension contributions). A company's net income is positive when revenues are sufficient to cover costs and expenses, including interest and taxes. Although net income may result in. When figuring adjusted net income, there will be no exclusions, deductions, or credits unless otherwise provided under income modifications and deduction. In the case of individuals, net income equals earnings accrued in a given period minus a few specific expenses and financial obligations. In other words, the. Net income is the profit your business earns after expenses and allowable deductions. Gross income and net income can provide a different perspective and affect. A company's net revenue represents the total amount it makes from its operations minus any adjustments such as refunds, returns, and discounts. A company's net. Net income is the amount of accounting profit a company has left over after paying off all its expenses.

Synonymous with net income, net profit is a company's total earnings after subtracting all expenses. Expenses subtracted include the costs of normal business. Read on to learn how to carry out a net profit calculation, some net profit examples, and an explanation of why net profit is important. Net income is the money left as profits after subtracting all costs and expenses from revenue. It is also called earnings, profits, or "the bottom line.". Net revenue, or net income, is the total amount of money you make from sales minus your direct expenses. It shows your business's total profits. Net income is the profit that remains after all expenses and costs, such as taxes, have been subtracted from revenue. It is profit as opposed to revenue. Without calculating net income, a business owner can't know whether they made or lost money over a set period, regardless of. Net profit is the money you get to keep after all expenses and taxes are paid. Net profit is often called the bottom line. It can determine the business' financial health. Positive or high net earnings mean a company is profitable or gaining more money than it's spending. This is an. Net income (NI), also known as net profit or net earnings, is a key financial metric that represents the total amount of profit earned by a company after. In the case of individuals, net income equals earnings accrued in a given period minus a few specific expenses and financial obligations. In other words, the. Net Income is the “bottom line” on a company's Income Statement and represents its net sales minus all expenses in the period – Cost of Goods Sold. Net Income is closely related to many other metrics used in financial statement analysis and valuation, such as Net Operating Profit After Taxes (NOPAT). In these cases, gross income simply refers to baseline salary, whereas net income refers to take-home pay after deductions, taxes, and so on. In this article. Net income is also known as net earnings. It's calculated as the overall sales revenue of a business minus the general expenses, costs of goods sold, taxes. Net earnings, also called net income, is the gross earnings minus mandatory withholdings and deductions, such as state and federal income tax and social. NET INCOME meaning: 1. a person's income after all tax and other costs have been paid: 2. the total income of a. Learn more. Gross vs. net income is a comparison between the amount an employer pays an employee (gross pay) and the amount the employee takes home after deductions (net. So, what does net income mean? Well, if gross income is all of the money you actually earned, then net income is the money you can actually use. Usually. Net income (NI), also known as net profit or net earnings, is a key financial metric that represents the total amount of profit earned by a company after. Net income is what remains of a company's revenue after subtracting all costs. It is also referred to as net profit, earnings, or the bottom line.

Hk Etf Stock

The iShares Hang Seng TECH ETF seeks to track the investment results of an index composed of 30 Hong Kong listed companies, in the technology sector or with. The Fund seeks to track the investment results of the MSCI Hong Kong 25/50 Index (the Underlying Index), which is a free float-adjusted market capitalization-. ETFs with Hong Kong Exposure ; FLHK · Franklin FTSE Hong Kong ETF · Asia Pacific Equities, %, % ; DVYA · iShares Asia/Pacific Dividend ETF · Asia Pacific. The listing application must be accompanied by the non-refundable deposit of the initial listing fee payable which is HK$20, The formal application must. investment, investing in US stock can be an option. Unlike HK listed stocks that generally require at least 1 lot (i.e. dozens and thousands of shares) for. SPDR® Gold Shares () is an ETF designed to track the price of gold. The iShares Core Hang Seng Index ETF seeks to track the investment results of an index composed of Hong Kong equities. The Tracker Fund of Hong Kong (TraHK) invests in all constituent blue chip stocks of the Hang Seng Index, providing easy and cost-efficient access to Hong. Find the latest iShares MSCI Hong Kong ETF (EWH) stock quote, history, news and other vital information to help you with your stock trading and investing. The iShares Hang Seng TECH ETF seeks to track the investment results of an index composed of 30 Hong Kong listed companies, in the technology sector or with. The Fund seeks to track the investment results of the MSCI Hong Kong 25/50 Index (the Underlying Index), which is a free float-adjusted market capitalization-. ETFs with Hong Kong Exposure ; FLHK · Franklin FTSE Hong Kong ETF · Asia Pacific Equities, %, % ; DVYA · iShares Asia/Pacific Dividend ETF · Asia Pacific. The listing application must be accompanied by the non-refundable deposit of the initial listing fee payable which is HK$20, The formal application must. investment, investing in US stock can be an option. Unlike HK listed stocks that generally require at least 1 lot (i.e. dozens and thousands of shares) for. SPDR® Gold Shares () is an ETF designed to track the price of gold. The iShares Core Hang Seng Index ETF seeks to track the investment results of an index composed of Hong Kong equities. The Tracker Fund of Hong Kong (TraHK) invests in all constituent blue chip stocks of the Hang Seng Index, providing easy and cost-efficient access to Hong. Find the latest iShares MSCI Hong Kong ETF (EWH) stock quote, history, news and other vital information to help you with your stock trading and investing.

Provides access to the Hong Kong stock market, allowing investors to precisely gain exposure to Hong Kong at a low cost. Bond ETFs · HK E Fund Citi Chinese Government Bond Years Index ETF - tracks Citi Chinese Government Bond Years Index · HK ABF HK IDX ETF –. Get Hang Seng TECH Index ETF (HK:Hong Kong Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. iShares MSCI Hong Kong Index Fund, formerly Shares MSCI Hong Kong ETF, (the Fund), is an exchange-traded fund. The Fund seeks to provide investment results that. ETF Overview ; EFUND LIQUOR-R · HK. CSI Liquor Index (net total return version), CNY ; CAM CSIR · HK. CSI , CNY ; HS RMB GOLD ETF. The Tracker Fund of Hong Kong ("TraHK") is an exchange-traded fund designed to provide investment results that closely correspond to the performance of the. The ETF via Stock Connect is an innovative business under the existing Shanghai-Hong Kong Stock Connect mechanism, which includes ETFs (exchange-traded funds). This is a list of all Hong Kong ETFs traded in the USA which are currently tagged by ETF Database. Please note that the list may not contain newly issued ETFs. These ETFs can be traded through a broker on a stock exchange similar to individual equity securities. As a concept of an investment company, the ETFs are a. HSBC Broking offers ETF trading on the Hong Kong Stock Exchange and other major markets around the world. Available ETFs cover a wide range of underlying. Learn more about Hong Kong ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news. Stay on top of the latest data on Equity, Commodity, Currency, Bond or Other ETFs in Hong Kong, including the ticker symbol, current price, daily high and low. listed on the Stock Exchange of Hong Kong with the highest net dividend yield Whilst Mirae Asset Global Investments (Hong Kong) Limited (“Mirae Asset HK. CSOP Hang Seng Index ETF (the “Sub-Fund”) is a sub-fund of the CSOP ETF Series III (“Trust”), which is an umbrella unit trust established under Hong Kong law. The Index is a freefloat-adjusted market capitalisation weighted index, and is designed to represent the 30 largest technology companies listed in Hong Kong. Find the latest Hang Seng China Enterprises Index ETF (HK) stock quote, history, news and other vital information to help you with your stock trading. Get iShares Core Hang Seng Index ETF (HK:Hong Kong Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. The stock price today is What Stock Exchange Is Traded On? is listed and trades on the Hong Kong stock exchange. Is a Good ETF to Buy. Inclusion of ETFs in Stock Connect · Daily Statistics - Shanghai-Hong Kong Stock Connect · Daily Statistics - Shenzhen-Hong Kong Stock Connect · Monthly Statistics. Global X ETFs Hong Kong offers a lineup that spans emerging trends and disruptive tech, income, core and commodities ETFs.

S&P 500 Down

Frequently Asked Questions · What is S&P Index value today? The current value of S&P Index is 5, USD — it has risen by % in the past 24 hours. In the United States, it began on January 3, , and ended on October 22, ; with the Dow Jones Industrial Average, the Nasdaq Composite, and the S&P S&P Index ; Open. 5, Previous Close5, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range4, - 5, S&P Component Year to Date Returns ; , DIAMONDBACK ENERGY INC · FANG ; , INTERCONTINENTAL EXCHANGE IN · ICE ; , CHUBB LTD · CB ; , TEXAS INSTRUMENTS. S&P 1 Year Return is at %, compared to % last month and % last year. This is higher than the long term average of %. The S&P 1. Interactive chart of the S&P stock market index since Historical data is inflation-adjusted using the headline CPI and each data point represents the. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. This is a change of % from last month and % from one year ago. Report, S&P Returns. Category, Market Indices and Statistics. Region. Historical Prices for S&P ; 08/02/24, 5,, 5,, 5,, 5, ; 08/01/24, 5,, 5,, 5,, 5, Frequently Asked Questions · What is S&P Index value today? The current value of S&P Index is 5, USD — it has risen by % in the past 24 hours. In the United States, it began on January 3, , and ended on October 22, ; with the Dow Jones Industrial Average, the Nasdaq Composite, and the S&P S&P Index ; Open. 5, Previous Close5, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range4, - 5, S&P Component Year to Date Returns ; , DIAMONDBACK ENERGY INC · FANG ; , INTERCONTINENTAL EXCHANGE IN · ICE ; , CHUBB LTD · CB ; , TEXAS INSTRUMENTS. S&P 1 Year Return is at %, compared to % last month and % last year. This is higher than the long term average of %. The S&P 1. Interactive chart of the S&P stock market index since Historical data is inflation-adjusted using the headline CPI and each data point represents the. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. This is a change of % from last month and % from one year ago. Report, S&P Returns. Category, Market Indices and Statistics. Region. Historical Prices for S&P ; 08/02/24, 5,, 5,, 5,, 5, ; 08/01/24, 5,, 5,, 5,, 5,

S&P - Top Losers ; IDEXX Laboratories, , ; FMC, , ; Dollar General Corporation, , S&P Component Year to Date Returns ; , DIAMONDBACK ENERGY INC · FANG ; , INTERCONTINENTAL EXCHANGE IN · ICE ; , CHUBB LTD · CB ; , TEXAS INSTRUMENTS. In the United States, it began on January 3, , and ended on October 22, ; with the Dow Jones Industrial Average, the Nasdaq Composite, and the S&P What happens if one of the mag 6/7 goes down? We can't expect the US to continue trade tariff policies and funding/engaging in armed conflicts. Get S&P Index .SPX:INDEX) real-time stock quotes, news, price and financial information from CNBC. Over the past 96 years, the S&P has gone up and down each year. In fact 27% of those years had negative results. As you can see in the chart below, one. PERCENTAGE POSITIVE AND NEGATIVE DAYS ACROSS VARIOUS PERIODS: S&P INDEX. (The Stock Market Tends To Have Relatively Near 50% Up Days & Down Days Across. S&P returns down into five components: Total return = (Sales growth / share count growth) * margin growth * P/E multiple growth + dividend yield. That's. How rare was yesterday? S&P down more than 1% yet more stocks higher than lower ( advancers yesterday). April last time we saw. The observations for the S&P represent the daily index value at market close. The market typically closes at 4 PM ET, except for holidays when. S&P · Nasdaq sees biggest drop in 2 years as tech earnings spark selloff · Wall Street recession fears ramp up as S&P tumbles · Dow drops 1, points on. Pre-markets ; Dow Futures. 41, + ; S&P Futures. 5, + ; NASDAQ Futures. 19, + In late February, the S&P ® Index closed in "correction" territory, defined as a more than 10% pullback from its last all-time high. The recent turbulence. The S&P rose 1%, the Nasdaq gained %, while the Dow Jones hit a S&P rising %, the Nasdaq up % and the Dow adding 2%. The main. Tech Down in Late Hours as Nvidia Fails to Inspire: Markets Wrap. updated Aug 28, Personal-finance. Buffett's Berkshire Tops $1 Trillion in Market Value. What happens if one of the mag 6/7 goes down? We can't expect the US to continue trade tariff policies and funding/engaging in armed conflicts. S&P 5, (%) ; AAPL · Apple. , () ; MSFT · Microsoft. , () ; AMZN · Amazon. , () ; JPM. Frequently Asked Questions · What is S&P Index value today? The current value of S&P Index is 5, USD — it has risen by % in the past 24 hours. Market-wide circuit breakers provide for cross-market trading halts during a severe market decline as measured by a single-day decrease in the S&P Index.

Hardest Mos In The Army

There's a great argument that the Marine Corps has the hardest military training of anyone, and here's why. Of course, when you reach the top, you can find them. Wesley Morgan is the author of "The Hardest Place: The American Military Adrift in Afghanistan's Pech Valley." He has covered the US military and its wars in. MOS Code 1 TX22 Any group of pararescuemencan work on the land, water, in the air, and any other restricted environments. Considered to be the toughest. M posts. Discover videos related to Hardest Badge in Military on TikTok Army Rapper Mos · 68x Mos Army · Rapping Mos Army · Army 88 M · 68k Mos Army · 68b Mos. The TOUGHEST MOS is that of 11B or Combat Infantryman. The reason this is true and is because NO OTHER MOS can say this. The Infantry is the. Pararescuemen endure some of the toughest training offered in the U.S. military. They complete the same technical training as EMT-paramedics, plus. The hardest branch to join depends on the MOS you want. The Navy, Marines, and Air Force are hard to join for aviation. The easiest service to join is, by. U.S. Army Special Operations Command · Joint Special Operations Command · Marine We are a unique organization, trusted with America's hardest problems. BEYOND THE CALL OF NORMAL DUTY. Every Marine takes on a Military Occupational Specialty (MOS) for which he or she is optimally trained, but beyond these roles. There's a great argument that the Marine Corps has the hardest military training of anyone, and here's why. Of course, when you reach the top, you can find them. Wesley Morgan is the author of "The Hardest Place: The American Military Adrift in Afghanistan's Pech Valley." He has covered the US military and its wars in. MOS Code 1 TX22 Any group of pararescuemencan work on the land, water, in the air, and any other restricted environments. Considered to be the toughest. M posts. Discover videos related to Hardest Badge in Military on TikTok Army Rapper Mos · 68x Mos Army · Rapping Mos Army · Army 88 M · 68k Mos Army · 68b Mos. The TOUGHEST MOS is that of 11B or Combat Infantryman. The reason this is true and is because NO OTHER MOS can say this. The Infantry is the. Pararescuemen endure some of the toughest training offered in the U.S. military. They complete the same technical training as EMT-paramedics, plus. The hardest branch to join depends on the MOS you want. The Navy, Marines, and Air Force are hard to join for aviation. The easiest service to join is, by. U.S. Army Special Operations Command · Joint Special Operations Command · Marine We are a unique organization, trusted with America's hardest problems. BEYOND THE CALL OF NORMAL DUTY. Every Marine takes on a Military Occupational Specialty (MOS) for which he or she is optimally trained, but beyond these roles.

Ranger School is one of the toughest training courses for which a Soldier can volunteer. Army Rangers are experts in leading Soldiers on difficult missions. Related to The Army Is The Easiest Hardest Job. Best Medicine Army JobEasiest Mos Job MilitaryHard Punishment ArmyThe Hardest ExamLow Energy Trump Email. Military cooks are some of the hardest If it was not for them, no soldier in combat or any MOS would be able to perform their duties in any capacity. Military Occupational Specialty (MOS) training. Then I came to Washington We have one of the hardest schools in the military and the Army spends. In the Army and Marines, the infantry units are the most demanding. In these two branches, their special forces are challenging MOSs, many will. Army Air Traffic Control Operator (MOS 15Q) has the highest suicide rate in the Army. Job description: your in a room talking to pilots and. Army, U.S. Army Reserve, or the Army National Guard. As such, AIT is different for each available Army career path, or Military Occupational Specialty (MOS). Get ready for the hardest training the United States military has to offer. Do you have what it takes? Want to start your journey with the Navy? Apply Now. Three adventurous veterans train alongside some of the world's most elite military units, getting an inside look at their tactics and weaponry. The select individuals who make up Air Force Special Warfare are the toughest, most highly trained warriors on the planet. Jul 30, - Army Spouse Hardest Mos In The Army Mug High quality mug, Dishwasher safe, Microwave safe, Decorated with full wrap dye sublimation. Being the Army 2nd lieutenant may very well be the hardest job in the Army to undertake It is at least twice as hard for a 2LT in a combat MOS. The demands. step 01 BASIC MILITARY TRAINING (BMT). weeks/Lackland AFB, TX. The first step to becoming an Airman happens in BMT where trainees learn military structure. Pre-screening, selection and then training to become a Navy SEAL are among the most comprehensive and difficult in the military. The washout rate at the Navy's. Jason Born you want to go through RASP, Ranger School, sniper school, and a few combat deployments like him? 2 mos. Largely considered the toughest basic training program of the United States Armed Forces, Marine training is 12 weeks of physical, mental, and moral. I immediately volunteered for duty there, but I was turned down because I had the wrong MOS (specialty). toughest military members. He was, I think, given. Army Rangers are seen as role model Soldiers and experience one of the toughest training experiences in the Army to become experts in leading high-pressure. Army MOS Options Requiring High Scores The Army has several MOS options with rigorous ASVAB requirements. For example, Cryptologic Linguist (35P) needs a. It is designed to prepare Special Forces candidates for the hardest physical phase of SF training - SFAS. MOS training (engineer/demo, weapons, medic.