bagmetstudio.ru

Tools

How Does Shorting A Stock Work

In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite. How to Short a Stock. As explained, short selling refers to borrowing stocks (usually from your broker) so as to sell them at the prevailing market prices. Essentially, shorting a stock is betting on the stock going down after a certain time. Short Selling occurs when an investor sells all the shares that he does not own at the time of a trade. This article will explain the several significant. To close a short position, a trader buys the shares back on the market—hopefully at a price less than at which they borrowed the asset—and. goes out of business, and some short sellers actively work to make that happen. Anyone that would like to short a stock must first arrange to borrow those. Shorting a stock involves borrowing shares to sell at a high price, hoping to repurchase them later at a lower price for profit. Short selling is selling securities you don't own hoping the prices will crash in near future. And Margin account is mandatory. The traditional method of shorting stocks involves borrowing shares from someone who already owns them and selling them at the current market price – if there. In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite. How to Short a Stock. As explained, short selling refers to borrowing stocks (usually from your broker) so as to sell them at the prevailing market prices. Essentially, shorting a stock is betting on the stock going down after a certain time. Short Selling occurs when an investor sells all the shares that he does not own at the time of a trade. This article will explain the several significant. To close a short position, a trader buys the shares back on the market—hopefully at a price less than at which they borrowed the asset—and. goes out of business, and some short sellers actively work to make that happen. Anyone that would like to short a stock must first arrange to borrow those. Shorting a stock involves borrowing shares to sell at a high price, hoping to repurchase them later at a lower price for profit. Short selling is selling securities you don't own hoping the prices will crash in near future. And Margin account is mandatory. The traditional method of shorting stocks involves borrowing shares from someone who already owns them and selling them at the current market price – if there.

How Does Short Selling Work. What does it mean to short a stock? Short selling is a trading strategy to profit when a stock's price declines. While that may. Successful short selling involves borrowing stocks, selling the borrowed stock and buying them back at a lower price. Find out how to short stocks here. In , U.S. regulators banned the short-selling of financial stocks, fearing that the practice was helping to drive the steep drop in stock prices during the. Short selling is a method in which you sell shares or securities that you don't have in your demat account using a margin account. Short selling entails taking a bearish position in the market, hoping to profit from a security whose price loses value. · To sell short, the security must first. Now you no longer have any shares of the stock, but you do have the $5, in your account that you received from the buyer of your shares ($50 x Shorting a stock is the act of betting against a company's share price, expecting it to decline. In this strategy, you borrow shares to sell them at the. Short selling works by borrowing shares – usually from a broker or pension fund – and selling them immediately at the current market price. Later, you'd close. Short selling, or shorting, means an investor expects a stock to lose value · In a short sell, investors borrow stocks and immediately sell in hopes of making a. Buy low and sell higher is how profits are made trading the long side of a stock price move. This strategy is practiced by traders and investors. One strategy to capitalize on a downward-trending stock is selling short. This is the process of selling “borrowed” stock at the current price, then closing. Basically, you divide the number of shares sold short by the average daily trading volume. The more days to cover, the more pronounced the effect can be. You first borrow shares of stock from a lender, sell the borrowed stock, and then buy back the shares at a lower price assuming your speculation is correct. You. How does shorting work? When a stock is falling in price, the strategy implemented to make a profit is called short selling. Shorting is pretty simple. You. A short sale generally involves the sale of a stock you do not own (or that you will borrow for delivery) How Stock Markets Work · Public Companies · Market. How to short a stock · Apply and qualify for a margin account with your brokerage. · Next, apply and qualify to add short selling to your margin account. When you short you sell the stocks and then buy them back when the price goes down, earning you a profit. If you do not own any shares of XYZ stock however you. What is short-selling, and how does it work? Short selling is a technique traders use to bet against a stock's price. The process begins with the investor. When shorting a stock via a traditional method, traders borrow shares they do not own. These shares are usually lent from their financial broker. The trader. How does short selling a stock work? Traders with research, timing and execution skills can make monumental returns by short selling. They research to find.

Suze Orman Mutual Funds

Kim Markel it's no less helpful than Suze Orman's. One size SUZE, how do you feel about S&P Mutual funds for retirees? 2 wks. 2. The Best Investment Advice I Ever Received: Priceless Wisdom from Warren Buffett, Jim Cramer, Suze Orman, Steve Forbes, and Dozens of Other Top Financial. And for my money, I think Exchange Traded Funds (ETFs) are an ideal way to invest the money in your IRA. Read Now. Suze Orman Blog and Podcast Episodes. k. Exchange-traded funds and index funds are similar to mutual funds in that each is a basket of different investment assets. One key difference: ETFs and index. Suze Orman's Financial Guidebook: by Suze Orman. $ Save $ List Ask Suze About Mutual Funds and Annuities Book Cover. Ask Suze. Mutual Funds (0). Search Criteria - - - Stocks (0). Company, Country Suze Orman's admonition is the best known, but variations on the theme do abound. Keep costs low. To make the most of your money, I recommend sticking with mutual funds that don't charge a commission when you buy or sell. Another important. Suze Orman Fanpage. Mark Pingel yes i agree get through to me directly. 44 mins. Debbie Zompa Snyderman. SUZE, how do you feel about S&P Mutual funds for. On this episode, we go to Suze School for a lesson on the importance of having a diversified portfolio and why you should never buy a loaded mutual fund. Read. Kim Markel it's no less helpful than Suze Orman's. One size SUZE, how do you feel about S&P Mutual funds for retirees? 2 wks. 2. The Best Investment Advice I Ever Received: Priceless Wisdom from Warren Buffett, Jim Cramer, Suze Orman, Steve Forbes, and Dozens of Other Top Financial. And for my money, I think Exchange Traded Funds (ETFs) are an ideal way to invest the money in your IRA. Read Now. Suze Orman Blog and Podcast Episodes. k. Exchange-traded funds and index funds are similar to mutual funds in that each is a basket of different investment assets. One key difference: ETFs and index. Suze Orman's Financial Guidebook: by Suze Orman. $ Save $ List Ask Suze About Mutual Funds and Annuities Book Cover. Ask Suze. Mutual Funds (0). Search Criteria - - - Stocks (0). Company, Country Suze Orman's admonition is the best known, but variations on the theme do abound. Keep costs low. To make the most of your money, I recommend sticking with mutual funds that don't charge a commission when you buy or sell. Another important. Suze Orman Fanpage. Mark Pingel yes i agree get through to me directly. 44 mins. Debbie Zompa Snyderman. SUZE, how do you feel about S&P Mutual funds for. On this episode, we go to Suze School for a lesson on the importance of having a diversified portfolio and why you should never buy a loaded mutual fund. Read.

Once you reach those goals, start investing in stocks and exchange-traded funds (ETFs). Real estate also makes a good investment option for some people. The. As recently as , she had this to say in an interview with bagmetstudio.ru: “I started to specialize in an investment called single premium whole life,” Orman. Suze Orman says you should put 'every single cent' in a Roth account. It is understood you don't pay income tax during retirement with Roth. He also encourages aggressive growth and balanced mutual funds for most investments. Once the mortgage is paid off, then step 7 (Invest for. about Mutual Funds and Annuities (Ask Suze) [Suze Orman] on bagmetstudio.ru *FREE* shipping on qualifying offers. about Mutual Funds and Annuities (Ask. Personal finance expert Suze Orman has long touted this straightforward advice: Stay with stocks. funds (ETFs) or mutual funds. Acorns — an automated. funds look LTC insurance manager ment Merrill Lynch money-market account money-market fund month monthly mortgage mutual Suze Suze Orman talk tell. Ask Suze About Mutual Funds and Annuities [Orman, Suze] on bagmetstudio.ru *FREE* shipping on qualifying offers. Ask Suze About Mutual Funds and Annuities. mutual funds vs “no load” mutual funds; The idea of a 12% return – why that's just not realistic; The idea of retiring at a certain, one-size-fits-all age. What you need to know before you buy mutual funds this time of bagmetstudio.rus ask if they can afford a family reunion, a Greek coin necklace. Suze Orman Ask ABOUT MUTUAL FUNDS AND ANNUITIES Paperback Book EXCELLENT COND ; Item Number. ; Custom Bundle. No ; Format. Book, Paperback ; Accurate. Financial expert Suze Orman gives advice on recovering from a declining market, investing in mutual funds and diversification. Buying Bond Mutual Funds: So according to Suze, because interest rates might go up, you should NEVER buy a bond fund because bond prices fall when rates rise. From health care plans to retirement funds, Suze Orman shows you the smartest ways to move your money. Just like a good mutual fund, Suze orman keeps getting. You Might Also Enjoy ; Ask Suze About Wills and Trusts · from: $ ; Ask Suze About Stocks and Bonds · from: $ ; Suze Orman's Will & Trust Kit: The Ultimate. Suze answers questions about opening investment accounts for children, catching up on a ROTH, maintaining retirement savings and so much more. Suze Orman's Women & Money (And Everyone Smart Enough to Listen). S1.E All Ask Suze & KT Anything: A Story of Hope, A Mini Suze School on Mutual Funds. Every financial advisor recommends having an emergency fund, but in what type of account or investment vehicle should you keep this emergency fund? Money market mutual funds that invest in federal government debt are safe. There are different types of MMMFs that own different types of. ASK SUZE ABOUT MUTUAL FUNDS AND ANNUITIES by Orman, Suze (, Pb) ; Top Rated Plus. Top rated seller, fast shipping, and free returns. ; eBay Money Back.

Luther Burbank Cd Rates

Certificates of Deposit (CDs) · Retirement Savings · Education Savings · Mortgage · Rates · Contact a Loan Officer · Home Equity · First Time Buyer · Smart. Lone Star Bank - Houston, Texas (TX), 7/28/09, %, 4 Years ; Luther Burbank Savings, 2/15/11, %, 12 Months ; Marcus by Goldman Sachs Bank, 2/27/18, %. The Very Best CD Rates and terms at Luther Burbank Savings Bank. Certificates of Deposit + savings and checking accounts too. The primary factors driving competition for deposits are customer service, interest rates, fees customers, from a basic reserve account (savings and CD. (14) Photo CD ROM Fee. $ Each. (15). (16) Hard Copy of the Annual Budget Luther King Day". (4) Third Monday in February, known as "President's Day. electronic copy on CD/DVD or USB stick of their RFQ/P response conforming to the requirements of this. RFQ/P to: Luther Burbank School District. C/O Caldwell. View every bank account offered by Luther Burbank Savings for August 24, Read Luther Burbank Savings reviews, set rate alerts & view financial data here. Great CD rates: % apy for 13 months; % apy for 7 months. 20 June Ms. Wendi Hernández: Welcoming, kind creating a friendly atmosphere conducive. 1 The best CD rates range from % APY to % APY. Certificates of deposit (CDs) are fixed-interest accounts where you can deposit your money and then. Certificates of Deposit (CDs) · Retirement Savings · Education Savings · Mortgage · Rates · Contact a Loan Officer · Home Equity · First Time Buyer · Smart. Lone Star Bank - Houston, Texas (TX), 7/28/09, %, 4 Years ; Luther Burbank Savings, 2/15/11, %, 12 Months ; Marcus by Goldman Sachs Bank, 2/27/18, %. The Very Best CD Rates and terms at Luther Burbank Savings Bank. Certificates of Deposit + savings and checking accounts too. The primary factors driving competition for deposits are customer service, interest rates, fees customers, from a basic reserve account (savings and CD. (14) Photo CD ROM Fee. $ Each. (15). (16) Hard Copy of the Annual Budget Luther King Day". (4) Third Monday in February, known as "President's Day. electronic copy on CD/DVD or USB stick of their RFQ/P response conforming to the requirements of this. RFQ/P to: Luther Burbank School District. C/O Caldwell. View every bank account offered by Luther Burbank Savings for August 24, Read Luther Burbank Savings reviews, set rate alerts & view financial data here. Great CD rates: % apy for 13 months; % apy for 7 months. 20 June Ms. Wendi Hernández: Welcoming, kind creating a friendly atmosphere conducive. 1 The best CD rates range from % APY to % APY. Certificates of deposit (CDs) are fixed-interest accounts where you can deposit your money and then.

Luther Burbank Corporation. ''Bank'' or ''LBS'' refers to Luther Burbank Savings, our banking subsidiary. This document contains forward-looking statements. We live in the area and, while walking 2nd St, noticed this branch opening about a year ago. It's a new building, very clean and open. The savings and CD rates. Click on the name of the bank to get their latest CD rates -Or- click the number to call them (Mobile) Luther Burbank Savings, Pacific Western. Mar 8. Florida Work Comp Proof Of Coverage · ; Mar 5. How Long Does An Insurance Claim Take? · ; Mar 3. Luther Burbank CD Rates - Top Saving Today. Luther Burbank Savings Ratio Analysis ; %, % ; %, % ; %, %. Luther Burbank Corp (NASDAQ:LBC) Q earnings call transcript rates than both the rates on loan payoffs, as well as the weighted average rate on. We know and agree that international shipping rates are incredibly expensive. CD & Vinyl purchases are limited to three copies per customer, per item. If. I started the process to open a CD online. I was given an account number and that was it. No communication. Decided to use another bank. Helpful 0. The State of Public Safety Disability Retirement Rates in the County Luther Burbank School District Misses the Mark in its Response to the Grand Jury. Today's best 6-month rate on a nationwide certificate of deposit (CD) is % APY, available from DR Bank. That's nearly three times what you can earn with. The Luther Burbank Savings CD has an APY of % - %. The interest you'll earn on your deposit depends on the term you choose. With term lengths of 7 and. Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. Multiple methods for making loan payments including online, mail, and in-branch. CD Management, Maintains current terms and interest rates for. Find the latest Luther Burbank Savings CD Rates, promotions, and offers here. At the moment you can earn % APY on a 6-month CD term. About Luther. Luther Burbank Savings. San Jose, CA · Bank Commercial Real Estate 3 month personal CD with a interest rate of % APR and % APY. See more. Luther Burbank Savings - Great CD rates: % apy for 13 months; By Why?, Luther Burbank Savings offers the CD online, the mayor of L.A. says. Passersby may have noticed a recent change in name for the Los Altos Luther Burbank Savings in Village Court Shopping Center, El Camino Real Ste. A Banks with the highest risk of collapsing according to market data ; Luther Burbank logo. Luther Burbank. LBC. % ; MainStreet Bancshares logo. We live in the area and, while walking 2nd St, noticed this branch opening about a year ago. It's a new building, very clean and open. The savings and CD rates. rates, fees charged, branch locations and hours, online and mobile banking CD products) to integrated operating accounts with cash management.

Bet On Sports App Real Money

Is there any app where you can bet on sports without using real money similar to slot machine games? Discussion. I just wanna bet for fun. Bet online with America's best sports betting site, FanDuel Sportsbook. Get live odds on sports and sign up with our latest promos! Since their foray into real money sports betting requires a totally different platform, FanDuel offers separate gaming apps for its sportsbook and DFS contests. Sports Betting Apps · Live Betting Sites Unlike typical sign up bonuses, second chance bets normally require the user to place a real-money wager first. Bet on Sports Sportsbook App brings real-time Betting Odds,, reduced juice (low vig), multiple betting options (Parlays, Straight, Teasers and Props) and. 1. WagerLab WagerLab is another excellent platform for prop betting and betting with friends. There is no option for real-money gambling. You can bet on. BetMGM: This is the best sports betting app for features, including a bet editor, same-game parlays, early cash out and live NBA, MLB and NHL streaming. Caesars. Here are the best sportsbooks and sports betting apps for sport fans and bettors, presented by the experts at Saturday Down South. Sports Betting Apps for Real Money. Sports Betting App, App Store Rating, Google Play Store Rating. DraftKings Sportsbook, Stars, Stars. Is there any app where you can bet on sports without using real money similar to slot machine games? Discussion. I just wanna bet for fun. Bet online with America's best sports betting site, FanDuel Sportsbook. Get live odds on sports and sign up with our latest promos! Since their foray into real money sports betting requires a totally different platform, FanDuel offers separate gaming apps for its sportsbook and DFS contests. Sports Betting Apps · Live Betting Sites Unlike typical sign up bonuses, second chance bets normally require the user to place a real-money wager first. Bet on Sports Sportsbook App brings real-time Betting Odds,, reduced juice (low vig), multiple betting options (Parlays, Straight, Teasers and Props) and. 1. WagerLab WagerLab is another excellent platform for prop betting and betting with friends. There is no option for real-money gambling. You can bet on. BetMGM: This is the best sports betting app for features, including a bet editor, same-game parlays, early cash out and live NBA, MLB and NHL streaming. Caesars. Here are the best sportsbooks and sports betting apps for sport fans and bettors, presented by the experts at Saturday Down South. Sports Betting Apps for Real Money. Sports Betting App, App Store Rating, Google Play Store Rating. DraftKings Sportsbook, Stars, Stars.

KICK OFF THE FUN WITH $ IN BONUS BETS AT BALLY BET SPORTSBOOK. Bet $25 and get $ in Bonus Bets*. homepage-screen-1 homepage-screen-2 app-preview-picks. Our real-money sportsbook features SGPs, live games in-app and much more. Play your favorite slots, table games and video poker titles in the casino. The best Sportsbook betting experience nationwide is the Bet On Sports Game. We bring online sports betting for all major sports right to your fingertips! Join. Bet On Sports is the #1 Sportsbook Game - Get $2, free BetPoints to play now. Enjoy simulated betting on NFL, NCAAF, NBA, MLB, NHL & more just like a. At FanDuel Sportsbook, you decide what to put your money on, including live in-game wagering, cross-sport parlays, futures, teasers, round robins, numerous prop. We offer live sports betting, in-play and pre-match betting on a wide range of sports, including NBA, NFL, NHL, soccer, and baseball. BetOnline brings you the best in online sports betting providing latest and best odds on all sports. Bet with BetOnline Sportsbook today. bet is a personal favorite for players who love to watch and wager on numerous sports in real-time seamlessly on the bet app. Its pre-built same-game. Join BetUS Sportsbook now and find today's real sport-betting odds, lines, and spreads across a wide array of games at BetUS Sportsbook. Bet on: NFL Odds. Download this app and create a real-money RI Sports Betting account. This exciting app will allow you to bet on sports when you are in the state of Rhode Island. Top 10 Real Money Gambling Apps · Bovada Betting App is our favorite. Bovada is MTS's top sports betting site. · BetOnline Betting App works like a dream. BetOnline is our pick for the best online betting app for the Super Bowl. It features a wide selection of Super Bowl prop bets and features promos specifically. A look at the best gambling apps, complete with a full review of the top legal online casinos and sportsbooks currently available during August Whether you're betting on NFL odds from your computer, building an NBA parlay with mobile sports betting on the BetMGM Sportsbook app (on iOS or Android), or. Additionally, you can bet online via the betPARX app. Hours · Menu. betPARX. Bet on all your favorite sports online for real money with Pennsylvania's #1 Casino. The #1 app for friendly sports betting. Available everywhere! Sign up for free and get started. No deposit, we use a virtual “units” system and no real money is. actual bonus. If you deposit $50, for instance, you'd wager This mobile sports betting app runs a two-coin model including Fliff Coins and Fliff Cash. View the latest odds and bet online legally, securely, and easily with the top rated sportsbook. Place a bet now! We have reviewed and ranked the best real money sports betting apps in Check out our top mobile sportsbook app recommendations. Gambling Apps · Online Casino games · Sports Betting · Horse Racing (where regulated and licensed separately from Sports Betting) · Lotteries · Daily Fantasy Sports.

Can You Put Money On A Chime Card

Sending money to a Chime account from a debit card directly is not typically possible; however, you can use a linked third-party service like. 20, Chime also has an option to help you grow your savings automatically: You can round up purchases to the next dollar and save the remainder. Chime does. You can deposit a maximum of $1, every 24 hours and up to $10, every month. You can deposit cash to your Chime Checking Account at Walgreens locations. The Chime® Visa® Debit Card is issued by The Bancorp Bank, N.A. or Stride Bank pursuant to a license from Visa U.S.A. Inc. The secured Chime Credit Builder Visa. The Chime debit card does not offer rewards, but you can get percent cash back on every purchase if you use their credit card. The Chime credit card. Bank Deposit Limits ; Institution, Limit ; Capital One Checking, One-time cash deposit maximum at an ATM is $5, ; Chime, Three deposits per day, $1, per. Now you can transfer money to your Chime card. The limit for this type of transfer is $25, per month, $10, per day. However, the transfer time is longer. CVS: CVS is a well-known pharmacy chain that also allows you to load your Chime card. However, be aware that CVS may charge a fee for this. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Sending money to a Chime account from a debit card directly is not typically possible; however, you can use a linked third-party service like. 20, Chime also has an option to help you grow your savings automatically: You can round up purchases to the next dollar and save the remainder. Chime does. You can deposit a maximum of $1, every 24 hours and up to $10, every month. You can deposit cash to your Chime Checking Account at Walgreens locations. The Chime® Visa® Debit Card is issued by The Bancorp Bank, N.A. or Stride Bank pursuant to a license from Visa U.S.A. Inc. The secured Chime Credit Builder Visa. The Chime debit card does not offer rewards, but you can get percent cash back on every purchase if you use their credit card. The Chime credit card. Bank Deposit Limits ; Institution, Limit ; Capital One Checking, One-time cash deposit maximum at an ATM is $5, ; Chime, Three deposits per day, $1, per. Now you can transfer money to your Chime card. The limit for this type of transfer is $25, per month, $10, per day. However, the transfer time is longer. CVS: CVS is a well-known pharmacy chain that also allows you to load your Chime card. However, be aware that CVS may charge a fee for this. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder.

They can provide you with accurate details on whether Casey's Gas Station is currently a supported cash deposit location for loading money onto. Direct deposit: You can set up direct deposit with your employer or other benefits payer to have your paycheck or benefits deposited directly. You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I deposit cash in my Chime. The deposit method you tried to use is not currently accepted (e.g. Chime/American Express/Prepaid gift cards). Please try again with one of the methods listed. You just tell the cashier you want to put money on your chime account. You swipe your card and give the money to cashier. It's available right. Once you enroll in direct deposit either in the mobile app or at bagmetstudio.ru, you can get your money up to two days ahead of schedule. Chime makes your funds. Transferring money from Cash App to Chime can be a great way to share money between your accounts per your needs. Gone are the days where you'll. To move money from Chime to Cash App, add your Chime debit card to Cash App. · You can also link your Chime bank account to Cash App to spend your funds with. Method 3: Use Your Chime Debit Card · Open Cash App and click “Banking.” · Select “Add Debit Card” and enter your Chime details. · Confirm the link between your. You complete a Chime Checking Account application online by providing your name, Social Security number and contact information. · Creating an account will give. Chime's mobile banking services do not rely on monthly service or overdraft fees or minimum balance requirements. Chime earns the majority of its revenue from. The Chime® Visa® Debit Card is issued by The Bancorp Bank, N.A. or Stride Bank pursuant to a license from Visa U.S.A. Inc. The secured Chime Credit Builder Visa. Tap Instant Transfer. If you haven't added an eligible debit card, tap Add Card and follow the instructions on your screen to add a Mastercard or Visa. Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I deposit cash in my Chime. What is considered a direct deposit? Chime defines a “qualified direct deposit” as any single deposit of $ or more from an employer, payroll provider, gig. Barcode and debit card cash deposits land in the Checking Account. Credit Builder card cash deposits first go through your Card Account and then land in your. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. You can also pay by email or phone # for someone who isn't on Chime. Step 2. Fill out the info. Enter the dollar amount and a quick note. Add an emoji.

Sunroom Ideas And Cost

A 4-season Florida room, designed for year-round use with full insulation, typically costs more—ranging from $26, to $,, or about $ Subject to credit approval. Monthly payment amount figured from average cost of $48, for a sunroom or patio enclosure with a $16, down payment. Bank. So I'm currently planning to remodel my backyard and I just wanted to get a general idea of the cost it might be. I live in an average cost of. What about the hassle of construction? Forget the idea of traditional construction. Four Seasons sunrooms are manufactured to your individual specifications. Do higher gas prices and clogged highways have you spending more time at home? Do you wish you had a great space for your kids and their friends to hang out? If. A sun porch or prefab sunroom addition costs $5, to $30,, and a glass solarium costs $30, to $, Connect with home addition contractors near you. While average screen room pricing starts around $25,, a more standard sunroom, rooms with fully enclosed glass, could range all the way up to $, Options and Upgrades · Glass transoms above or below windows, to increase light and views, maximizing the sunroom experience. · Matching siding that blends with. According to Remodeling Magazine, a square-foot sunroom addition with footings and slabs-on-grade foundation can cost up to $75,, while a survey. A 4-season Florida room, designed for year-round use with full insulation, typically costs more—ranging from $26, to $,, or about $ Subject to credit approval. Monthly payment amount figured from average cost of $48, for a sunroom or patio enclosure with a $16, down payment. Bank. So I'm currently planning to remodel my backyard and I just wanted to get a general idea of the cost it might be. I live in an average cost of. What about the hassle of construction? Forget the idea of traditional construction. Four Seasons sunrooms are manufactured to your individual specifications. Do higher gas prices and clogged highways have you spending more time at home? Do you wish you had a great space for your kids and their friends to hang out? If. A sun porch or prefab sunroom addition costs $5, to $30,, and a glass solarium costs $30, to $, Connect with home addition contractors near you. While average screen room pricing starts around $25,, a more standard sunroom, rooms with fully enclosed glass, could range all the way up to $, Options and Upgrades · Glass transoms above or below windows, to increase light and views, maximizing the sunroom experience. · Matching siding that blends with. According to Remodeling Magazine, a square-foot sunroom addition with footings and slabs-on-grade foundation can cost up to $75,, while a survey.

Remodeling provides the indispensable business tools, product information, design ideas, cost-estimating tools, and management advice that enable full-service. Budget-Friendly Sunroom Ideas Based on Price Range · $6, to $13, · $26, and above: ; Pros of Adding a Sunroom. Increased Home Value: · Enhanced Living. Regardless of whether you say Florida room or sunroom The concept first became popular in the 50's and 60's. Homeowners were looking for a way to enjoy their. But on average, they can range anywhere from $10, to $70, A 3 season sunroom is a cost-effective alternative to a 4-season sunroom, because it's not. A four season sunroom the average sunroom cost can be between $24, and $80, Below will give you an idea of sunroom prices by square footage. Square. Styles & Pricing Guide · Gallery · Full Gallery · Virtual Tours. Contact Us Explore Your Sunroom Ideas. Starting with your initial contact with us, you. Suit Yourself - Linen. Design your dream area rug with Suit Yourself - Linen carpet tiles by FLOR. Available in a variety of color options to suit any space. Sunroom Ideas · What can I use my sunroom for? · What materials are sunrooms built with? · What type of sunroom decor do I need? · Can sunroom additions double as. Yet, with Sunrooms, the increase to your home's value typically exceeds 50% of the Sunroom's cost. Even better yet, some real estate experts say you can see. Sunroom Ideas on a Small Budget · Repurpose and Reuse · Shop Secondhand · Find Freebies · DIY Decor · Maximize Natural Light · Add Greenery · Utilize Multi-. What Are the Average Costs of a Sunroom? · Prefab sunroom: $5,$30, · Solarium: $30,$, · Three-season sunroom: $20,$50, · Four-season sunroom. These sunrooms use floor-to-ceiling windows to let in maximum sunlight. They are slightly cheaper than other sunroom styles. The nationwide average cost for a. Depending on whether you are looking for a three or Four Season room, we have price ranges anywhere from eight to eighty thousand. We like to think of each of. Because of all these variables, sunrooms often have a wide range of associated costs. Labor for most sunroom projects is charged as a flat fee, which varies. Is it cheaper to build a sunroom or an addition? Sunrooms are generally much cheaper than a full addition. This is because sunrooms don't have to meet all the. Navigating the ever-changing market can make researching how much a sunroom costs daunting. At the time of writing (), the average sunroom cost typically. Design Ideas for Sunroom Furnishings A sunroom with three outdoor chairs and sunlight streaming through large windows. Coordinate your sunroom furniture to. Filter. All Filters. Done. Room. Style. Budget · Room. Room. Done. All Rooms · Living Photos · Sunroom · Style. Style. Done. Contemporary · Modern · Traditional. Expert Overview · Making a list of ways you intend to use your sunroom can help you formulate a plan for building a sunroom on a budget. · Low interest credit. We designed a few sunroom addition plans to give you an idea of how much these solariums can cost to build. To get an accurate cost for your addition, you will.

Average Monthly House Insurance Bill

Per Month Average Cost. Erie County, $1,, $ Monroe County, $1,, $85 The number of home insurance claims filed across a state can also affect the. How Much Does Homeowners Insurance Cost? The average cost of homeowners insurance in the U.S. is $1, per year, or $ per month.2 But homeowners. Average cost of homeowners insurance by state for $, in dwelling coverage ; New Jersey. Average annual premium. $1, Average monthly premium. $ Although not required by law, homeowner's insurance protects you and your lender against a sudden home catastrophe. According to Bankrate, in the average. State Farm agent stands to greet male customer. Market value? Replacement cost? Learn what to consider when determining the value and potential coverage needs. Remember that flood insurance and earthquake damage are not covered by a standard homeowners policy. If you buy a house in a flood-prone area, you'll have to. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! Average Annual Premium in New York Cities for Homeowners Insurance ; Buffalo, Average Annual Premium ($K Dwelling Coverage)$, Average Annual Premium ($K. How much does homeowners insurance cost? The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on. Per Month Average Cost. Erie County, $1,, $ Monroe County, $1,, $85 The number of home insurance claims filed across a state can also affect the. How Much Does Homeowners Insurance Cost? The average cost of homeowners insurance in the U.S. is $1, per year, or $ per month.2 But homeowners. Average cost of homeowners insurance by state for $, in dwelling coverage ; New Jersey. Average annual premium. $1, Average monthly premium. $ Although not required by law, homeowner's insurance protects you and your lender against a sudden home catastrophe. According to Bankrate, in the average. State Farm agent stands to greet male customer. Market value? Replacement cost? Learn what to consider when determining the value and potential coverage needs. Remember that flood insurance and earthquake damage are not covered by a standard homeowners policy. If you buy a house in a flood-prone area, you'll have to. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! Average Annual Premium in New York Cities for Homeowners Insurance ; Buffalo, Average Annual Premium ($K Dwelling Coverage)$, Average Annual Premium ($K. How much does homeowners insurance cost? The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on.

This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded to. Payment options will vary by insurer, but home insurance premiums are typically paid annually or monthly. References to average or typical premiums. In a recent survey by bagmetstudio.ru, 43% of homeowners indicated their insurance premiums have increased in the past year, rising to an average of $1, Let's. Contents. Compare Homeowners Insurance Companies. Rating Details. Average Home Insurance Cost in Florida. More AVERAGE MONTHLY PREMIUM. Tallahassee**. “The First State” checks in at third for most expensive states to insure a home in, with average annual rates of $1, Budgeting for the monthly cost of. The average cost of homeowners insurance in Palm Beach County is about $1, monthly, or $12, annually, which is well above the national and state average. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. property insurance policies within a month period. Citizens Property House Bill establishes property insurance discounts for policyholders. Assembly Bill () Establishes a minimum month period in non-catastrophic situations (with additional 6-month extensions if the policyholder can. The average cost of homeowners insurance is $ per month. However, rates vary significantly from state to state and city to city. Home insurance monthly costs. How much is home insurance in New York? The average cost of homeowners insurance in New York is $1, annually or $ monthly. That's based on coverage of. Determine how much home insurance coverage you need by first understanding the difference between estimated replacement cost and market value. $ – Florida; $ – Louisiana; $ – Oklahoma; $ – Texas; $ – Rhode Island; $ – Colorado. Over a year period, the average change in. Home Insurance Calculator ; Allstate · 79 · $/mo ; State Farm · 86 · $/mo ; USAA · 86 · $/mo. A one bedroom property costs £ on average to insure, but that goes up to £ for a four bedroom home, a 70% increase. Monthly vs. annual payments. It's. Typical Homeowner Insurance Forms. An insurance form is another name property, some home insurance policies provide limited coverage for small boats. home property insurance at $1,, while Monroe County had the highest average cost at $7, Property insurance: 10 highest priced Florida counties. Monroe. Nationally, homeowners pay an average premium of $ per year. Landlord insurance policies usually cost about 25% more than homeowners insurance policies, according to the Insurance Information Institute. The average.

Daily Stock Market Technical Analysis

Technical analysis in trading aims to evaluate investments and identify opportunities using only price and volume data. It isn't immediately obvious why this. Technical analysis is the most widely used method of analysis by private traders on the stock exchange. It is based on the study of historical prices. Technical indicators are used by traders to gain insight into the supply and demand of securities. Here we look at seven such technical trading tools. At its core, technical analysis aims to understand supply and demand in the market to determine the likely direction or trend of security, enabling traders to. Technicals are calculated and updated every 20 minutes during the trading day using delayed market data. Barchart Premier users can set Alerts on Technicals. Technical analysts attempt to find patterns in charts of stocks (individual companies or the broader market), bonds, commodities, currencies, indexes and even. Technical analysis is a form of investment valuation that analyses past prices to predict future price action. Real Time technical analysis overview for the major stocks - derived from moving averages and key technical indicators shown for specific time intervals. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Technical analysis in trading aims to evaluate investments and identify opportunities using only price and volume data. It isn't immediately obvious why this. Technical analysis is the most widely used method of analysis by private traders on the stock exchange. It is based on the study of historical prices. Technical indicators are used by traders to gain insight into the supply and demand of securities. Here we look at seven such technical trading tools. At its core, technical analysis aims to understand supply and demand in the market to determine the likely direction or trend of security, enabling traders to. Technicals are calculated and updated every 20 minutes during the trading day using delayed market data. Barchart Premier users can set Alerts on Technicals. Technical analysts attempt to find patterns in charts of stocks (individual companies or the broader market), bonds, commodities, currencies, indexes and even. Technical analysis is a form of investment valuation that analyses past prices to predict future price action. Real Time technical analysis overview for the major stocks - derived from moving averages and key technical indicators shown for specific time intervals. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors.

This tool provides stock analysis, intraday, daily and yearly stock charts, quotes, and proprietary trading indicators. · Use new technical analysis to learn. Everything you see on StockCharts is designed with one goal in mind: to help you succeed in the markets. Our charting and analysis tools, portfolio management. This course is for all of those who want to Get the Essence of investing & trading in US Stock Market Indices. - so in this Udemy US and US day trading. Technical analysis is a method of analysing the market, focusing on trends in prices and trading volume. It helps traders identify areas where there may be. This is the daily Stock Market Brief where I use Technical Analysis to forecast the price movement bagmetstudio.ru videos give a good sense of direction where the. Technical analysis is a way of using patterns in price charts to help make trading decisions. Also known as chartism, technical analysis differs from. Given the focus on price and volume moves, traders have traditionally used technical analysis for shorter-term trades or to help identify entry prices on stocks. Technical analysis is the most widely used method of analysis by private traders on the stock exchange. It is based on the study of historical prices. This course is for all of those who want to Get the Essence of investing & trading in US Stock Market Indices. - so in this Udemy US and US day trading. Learning technical analysis of stock trends is a great way to develop your day trading skills especially when it comes time to enter or exit a trade. The Day Trader¿s Guide to Technical Analysis shows you how to use technical analysis to strengthen your knowledge¿of what has occurred in the past, what should. Daily technical analyses of major Forex pairs and Indices: EUR/USD, USD/JPY, GBP/USD, EUGERMANY30, US30 – prepared by a financial analyst with over. Daily reports typically have a technical overview on SPX , covering near-term trend, momentum, and areas of support/resistance. This is followed by other. Trading Advice - Stock Traders Daily offers Trading Advice, Technical analysis, Swing Trading, Day Trading and Long Term Investment Strategies through its. The Stock Market Is Dropping. Here's How Far it Can Fall. Jacob Sonenshine. July 25, am ET. The Nasdaq Composite has dropped below its day moving. The Stock Market Is Dropping. Here's How Far it Can Fall. Jacob Sonenshine. July 25, am ET. The Nasdaq Composite has dropped below its day moving. Trading Advice - Stock Traders Daily offers Trading Advice, Technical analysis, Swing Trading, Day Trading and Long Term Investment Strategies through its. Technical analysis predicts stock prices using historical price patterns and market sentiment. daily, weekly, or monthly -- volatility in a stock's price. How To Find Emerging Market Leadership & Prep Your Watch List For The Next Uptrend. 3/15/ ; Irusha Peiris: Lessons From Bill O'Neil On Stock.

Cost To Franchise A Taco Bell

“Partnering with Taco Bell has been a game-changer for me as a franchisee. The unparalleled support from the corporate team, coupled with innovative marketing. The investment required to open a Taco Bell Franchise is between $,$3,, There is an initial franchise fee of $25,$45, which grants you the. proposition. Taco Bell franchisees should expect to invest anywhere from half a million to two and a half million dollars (depending on location, restaurant. Taco Bell has an initial franchise fee of up to $45,, with a overall initial investment range of $1,, to $3,, Initial Franchise Fee: $45, TIL In order to open a Taco Bell franchise, Taco Bell requires you to have a minimum net worth of $ million and at least $, in liquid. The Cost. When considering a Taco Bell franchise opportunity, prospective franchisees should have a minimum of $, in liquid capital available. What Is The Taco Bell Franchise Fee? The current initial franchise fee for one Taco Bell franchise varies from s $25, and $45, But what is the fee for? For a Taco Bell restaurant franchise unit, the estimated total investment ranges between $1MM - $MM (size dependent & excluding real property). Initial. What Does a Taco Bell Franchise Cost? To buy a franchise with Taco Bell, you'll need to have at least liquid capital of $, Franchisees can expect to make. “Partnering with Taco Bell has been a game-changer for me as a franchisee. The unparalleled support from the corporate team, coupled with innovative marketing. The investment required to open a Taco Bell Franchise is between $,$3,, There is an initial franchise fee of $25,$45, which grants you the. proposition. Taco Bell franchisees should expect to invest anywhere from half a million to two and a half million dollars (depending on location, restaurant. Taco Bell has an initial franchise fee of up to $45,, with a overall initial investment range of $1,, to $3,, Initial Franchise Fee: $45, TIL In order to open a Taco Bell franchise, Taco Bell requires you to have a minimum net worth of $ million and at least $, in liquid. The Cost. When considering a Taco Bell franchise opportunity, prospective franchisees should have a minimum of $, in liquid capital available. What Is The Taco Bell Franchise Fee? The current initial franchise fee for one Taco Bell franchise varies from s $25, and $45, But what is the fee for? For a Taco Bell restaurant franchise unit, the estimated total investment ranges between $1MM - $MM (size dependent & excluding real property). Initial. What Does a Taco Bell Franchise Cost? To buy a franchise with Taco Bell, you'll need to have at least liquid capital of $, Franchisees can expect to make.

Taco Bell Franchise Costs · From their latest disclosure document a Traditional Unit or a Power Pumper, (those are the standalone stores), will cost between. Find detailed ownership information about Taco Bell franchise including the franchise cost, fees, total investment and initial liquid capital requirements. According to information from Taco Bell, the estimated total investment for a new Taco Bell franchise ranges from $ million to $ million. Taco Bell Franchise Cost. Taco Bell charges a franchise fee of around $20, and requires a total initial investment of $, to $2,, Taco Bell. Because to buy into a Taco Bell Franchise the cost is between a low of $, to $ million up front with a $55, per year franchise fee. For those interested in opening a Taco Bell, the current initial franchise fee is between $25, and $45, This fee gives the Taco Bell franchisees the. It takes only around ₤55, to ₤90, to own a Taco Bell franchise. This leads to a total investment of around ₤, to begin the operation of a new. cost more to sue the franchisor in Orange County, California than in your home state. Certain states may require other risks to be highlighted. Check the. INITIAL FEES. Taco Bell charges an initial franchise fee of $45, for a new Traditional Unit or for a Power Pumper. The initial franchise fee for a new In. Planning For and Meeting The Requirements · Taco Bell does not provide financing. · You can apply for financing with partners. · Not all third party financing. The average Taco Bell franchise grosses million a year. That works out to $ and change a day. Net profit is 80 to bucks a year. Thus, Taco Bell requires each applicant to have a minimum net worth of $ million. On top of their net worth, they must also have at least $, available. In this article, we'll explore the various costs associated with owning a Taco Bell franchise, including the initial investment, ongoing costs, and potential. Taco Bell Express has an initial franchise fee of up to $22,, with a overall initial investment range of $, to $, The initial cost of any. Taco Bell Franchise Cost · Liquid Capital Required: $, · Net Worth Required: $1,, · Total Investment: $, - $, · Franchise Fee: $22, Taco Bell Express franchise has a $ franchise cost, and a 10%% Royalty. In contrast, they also have an AUV of. cost more to sue the franchisor in Orange County, California than in your home state. Certain states may require other risks to be highlighted. Check the. Training for new franchisees consists of web-based, on the job and classroom training, and is taught by a certified Taco Bell training instructor in a certified. brands - the same company that oversees Pizza Hut and KFC. To become a Taco Bell franchise owner, you must meet the following qualifications: have previous. Taco Bell franchises are well-known fixtures of the fast-food industry, offering Mexican-inspired menu items, such as tacos, nachos, and burritos.

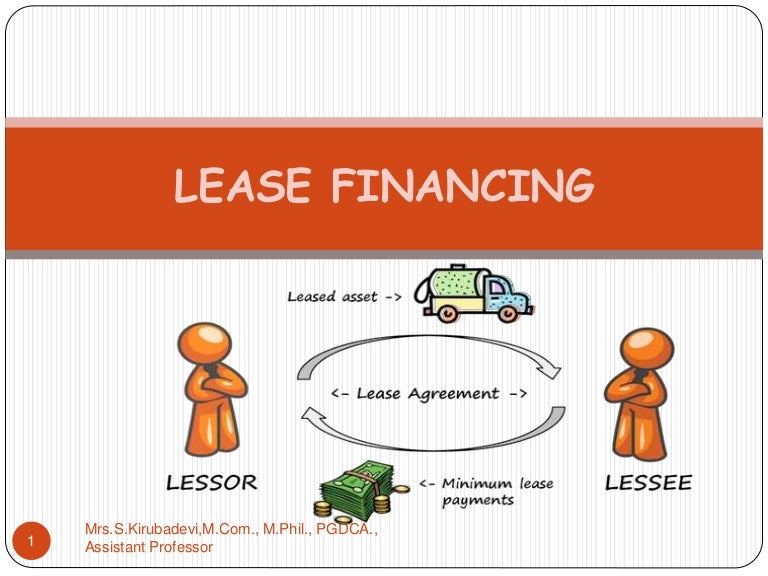

Lease Buyout Financing

If the buyout amount is higher than the market value, you may be overpaying for the car. Financing a lease buyout may come with higher interest rates. Note that loan rates depend on a number of factors including credit score, loan amount, loan term, and other eligibility requirements. Credit pull. A car lease buyout occurs when you decide to buy the car you're currently leasing at a pre-determined purchase price. This can happen at the end of your lease. What is a lease buyout--and is it the right choice for you? All car lease buyout definitions center on this: you'll finance the vehicle's remaining value. An auto lease buyout can help you buy your vehicle instead of returning it. See if you pre-qualify in minutes with no impact to your credit. If you love your current leased car but don't love the increase in a new car payment, CFCU has a solution for you. Our Auto Loan rates and competitive financing. Compare lenders that make auto lease buyout loans, current rates and common requirements. More About Getting A Lease Buyout Loan. Fill out our simple, two-minute application and you'll be one step closer to buying your leased vehicle. The application. Option 2: finance through Toyota as a new car around % confirmed no penalty of paying off early. Am I missing anything? Have to. If the buyout amount is higher than the market value, you may be overpaying for the car. Financing a lease buyout may come with higher interest rates. Note that loan rates depend on a number of factors including credit score, loan amount, loan term, and other eligibility requirements. Credit pull. A car lease buyout occurs when you decide to buy the car you're currently leasing at a pre-determined purchase price. This can happen at the end of your lease. What is a lease buyout--and is it the right choice for you? All car lease buyout definitions center on this: you'll finance the vehicle's remaining value. An auto lease buyout can help you buy your vehicle instead of returning it. See if you pre-qualify in minutes with no impact to your credit. If you love your current leased car but don't love the increase in a new car payment, CFCU has a solution for you. Our Auto Loan rates and competitive financing. Compare lenders that make auto lease buyout loans, current rates and common requirements. More About Getting A Lease Buyout Loan. Fill out our simple, two-minute application and you'll be one step closer to buying your leased vehicle. The application. Option 2: finance through Toyota as a new car around % confirmed no penalty of paying off early. Am I missing anything? Have to.

Choosing between leasing or financing your next vehicle can be difficult, but in most cases, you won't have to make that decision right away! Finance Department Can You Trade In A Leased Vehicle to Another Dealership? Nearing the end of your car lease in the Matthews area? Traditionally, drivers who. Just go on the BMW site and request a payoff amount and you can the numbers. Keep in mind interest rates are rising so when doing your future purchase make sure. A lease buyout loan lets you buy the car you're already driving from the leasing company for a predetermined price. With an auto lease buyout loan from PNC Bank, you can buy your existing car instead of returning it. View current rates and apply online. With an auto lease buyout loan from PNC Bank, you can buy your existing car instead of returning it. View current rates and apply online. While you can pay for the leased vehicle with cash, Pearl Hawaii Federal Credit Union offers an Auto Lease Buyout Loan to our members. Before Buying Out Your. An early lease buyout can be utilized to avoid lease penalties. If worried about going over the allotted mileage, or if there is damage to the car, then an. Don't forget, we can offer flexible financing terms in addition to our Best-in-Market Auto Loan rates as low as % Fixed APR. Most importantly, make sure you. The lease buyout definition is when you purchase your leased vehicle for the price listed in your contract. This means you move from leasing to financing your. Buy your leased vehicle with a lease buyout loan with U.S. Bank. A lease buyout loan lets you purchase the vehicle for the amount noted in your lease. Harvard FCU can help you stay in your car and buy out your lease! We offer loans with competitive rates and flexible repayment terms, up to 72 months. Once you've done your homework, contact your leasing company to request a lease buyout package. The offer should include residual value, any remaining payments. If you need lease purchase financing, you can visit bagmetstudio.ru to apply. Lease purchase financing is only available for those named on the. If you've come to love your leased vehicle, a lease buyout will allow you to purchase the vehicle at or before the end of your lease contract for the price of. Explore PSECU lease buyout loan options. See current PSECU auto lease buyout loan rates. Learn how to finance your car lease buyout with a loan from PSECU. A car lease buyout occurs when you purchase your vehicle at the end of your leasing term. Let's say you lease a used car and sign a two-year contract. Over. Lease buyout loan terms typically range from 36 months. You can use our helpful loan amount calculator to find out how much you can actually afford based on. If you have questions about lease buyout loans, auto loan interest rates, or how to buy a car online, contact your local authorized Land Rover Finance Center. You can get a good interest rate to finance the buyout price. Another perk is knowing the condition and history of the vehicle you've been leasing, unlike when.